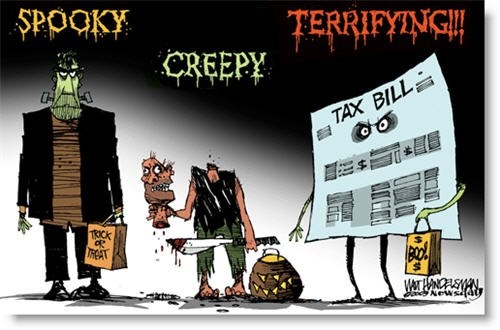

With Halloween around the corner, I’d like to join in the festivities by sharing some scary tales from the world of bookkeeping. With all of the numbers involved, bookkeeping on its surface can already seem scary to some. Once you hear a few horror stories from within, you’ll see how scary things really can get.

A few years ago I was personally involved with a bookkeeping horror story. A business owner had a friend who ran into some tough times, so the business owner gave the person a job doing her books. After three years of employing this person, the books showed a large profit when in reality the company had huge losses due to deliberate improper bookkeeping practices. She now owed a lot of money to the IRS and when they came knocking for the money she was unable to pay up. After this misconduct by her bookkeeper, she hired Clarity Finances and an accountant to right the ship. In a way, there is no happy ending for this story as the business was forced to close, a friendship ended and the business owner went back to her former career.

Some simple searching around the internet will show you tons of stories like this where a business thinks things are running smoothly until someone else takes notice of the errors or worst of all the IRS steps in. There are some check and balances that can prevent such horror stories. A common theme you will see in many of these stories will be that no one was watching. It helps to have a few different sets of eyes on your numbers. Keep an eye on things like petty cash, which can be manipulated rather easily. As scary as these things can sound, ill intended mistakes in the numbers of a business most often times are rare. To cover all of your bases and assure accuracy, it’s best to have an outside accounting firm or bookkeeping company, like Clarity Finances look over your numbers.

So I don’t scare too many people, I’ll finish this week’s post with a story that has a happy ending. I had a client who was building a new home and she wanted me to look over her numbers. I noticed a discrepancy in the numbers on her invoices where she would have overpaid by roughly $30,000. This mistake was not intentional by the contractor; it was just that without an extra set of trained eyes, the error would go unnoticed. She and her family have been living happily in this beautiful home for the last five or so years.

Hearing stories like these may make you feel nervous about your numbers, so it is imperative that you have the right people on the job. Clarity Finances is here for the business owners who seek trust and accuracy in their bookkeeping.

Have a happy and safe Halloween!

Here are a few bonus tips for business owners to ensure accuracy with their numbers:

Don’t have the person who signs the checks also sign invoices.

Don’t make the checks easy to sign out so that suspect purchases cannot be made.

Get a second or third set of eyes to look over things like invoices.

Reconcile your accounts with your bank.

Always consider a third party to look over your numbers.