I hope you all had a happy and safe New Year’s Eve celebration. As I’ve stated in previous blog posts, my move to Florida has overall been a great thing in my life, but while I was having fun adapting to warm weather all year round, we are having our own cold snap—not the deep freeze of up north but in the 30’s at night. The top of Florida has even seen a flurry or two. I am told this should be over in a week or two though.

If you saw my last blog post it was short and sweet, simply containing a short message of well wishes and a picture that I took while out and about of a palm tree with Christmas light on it. That picture can sum up my times in Florida thus far; things are slightly different down here (like being warm during the winter months), yet quite similar to where I grew up (like the availability of Wawa convenience stores).

Now that we are in 2018 I thought I’d write on something that will have an impact on all of us, tax reform. No matter where you stand on this overhaul of our tax system, I’ll do my best to translate what at times can be confusing to most people: taxes.

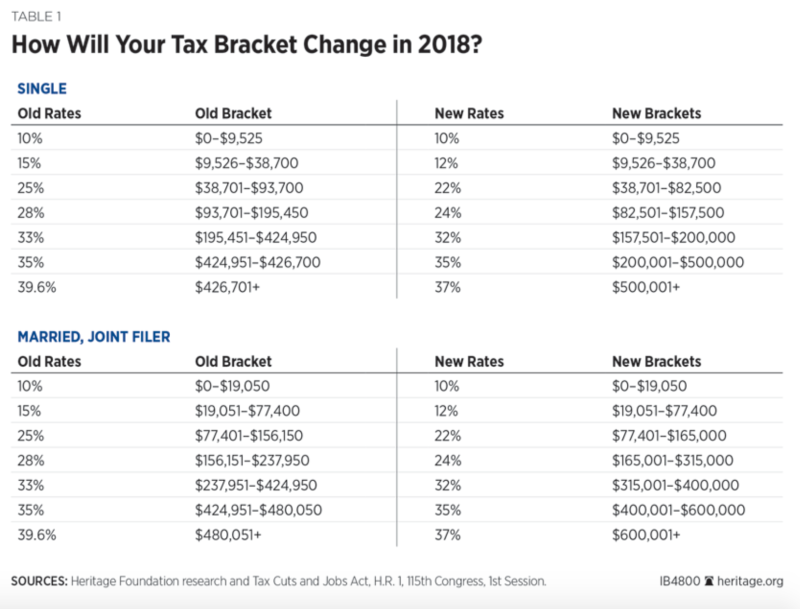

The Tax Cuts and Jobs Act (TCJA) was signed into law on December 22, 2017. The new tax plan takes effect on January 1, 2018, which most importantly means that it does NOT affect the taxes that you will be filing in April 2018. New tax brackets were established and they are listed below in the image. These new brackets will expire in 2025.

What most people want to know about this tax overhaul can be boiled down to one question: does it save me money? The answer to that question depends on which new bracket you find yourself in but can be answered with a “yes.” According to The Tax Policy Center for example, if you earn $65,000 a year you’ll save around $930 in 2018. If you make $500,000 a year, you will save around $13,480 in 2018.

If you’re curious about how much you’ll save under the new tax bill, use this tool from the Tax Policy Center. This tool is a just an estimate but can give people a better idea of how the TCJA impacts them specifically.

For businesses and business owners, this bill could be considered a win. The corporate tax rate will drop from 35 percent to 21 percent, which is seen by some as a way to boost the US economy and thus workers’ wallets.